by Graeme Gordon

"Naturally the Liberals won’t admit that this thing is meant to pump money into their coffers, so they’ve employed other methods of convincing the public that it’s a good thing."An excellent guide.

As usual B.C.'s carbon tax, being the first in North America, is cited by various "experts" (proponents of carbon taxes) to be a fine example of the effectiveness of such taxes in reducing carbon emissions. This has always struck me as a highly dubious claim for a number reasons:

1. StatsCan multi-year data show no significant differences in the pattern of fossil fuel consumption between BC and provinces without a carbon tax (the other nine).

2. Fuel prices are notoriously inelastic. Demand is relatively impervious to price changes. People use what they gotta use.

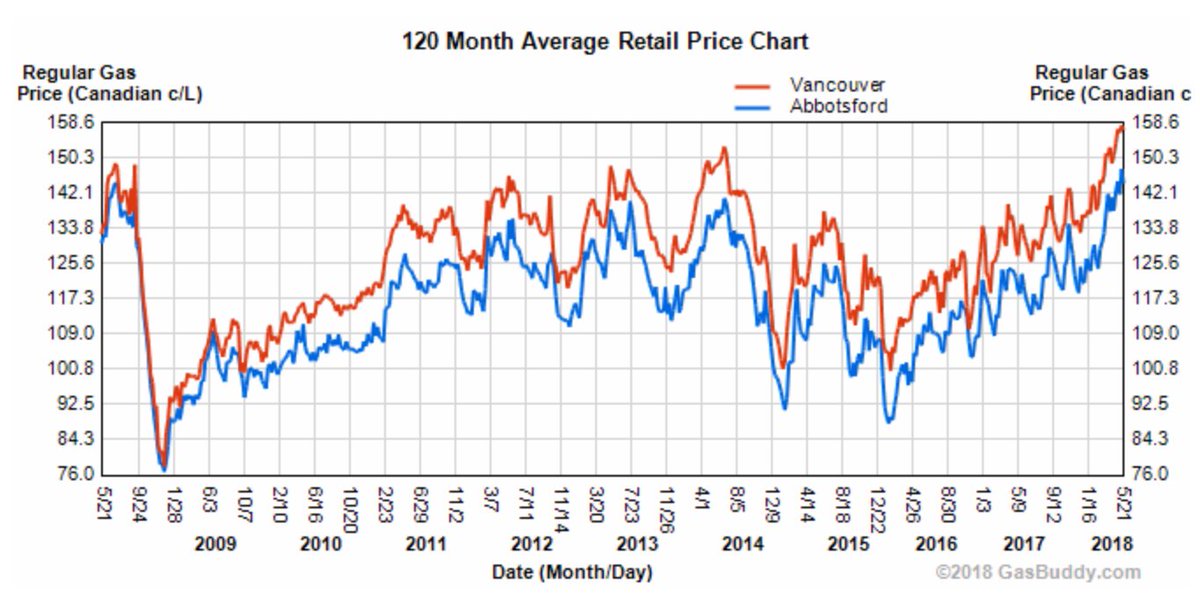

3. BC's carbon tax (2.4 c/L in 2008 - 7.78 c/L in 2018) is utterly swamped by market price fluctuations. So, even ignoring point 2, trying to attribute consumer demand changes to the carbon tax is extremely difficult. From GasBuddy:

1 comment:

You've also left out of your analysis the damage done to public institutions such as schools and hospitals because money which should have gone to maintenance had to be diverted to this tax. Was an openly discussed issue early but seems to have disappeared from public view. Did the BC gov't quietly reimburse these institutions for the tax payments, thereby allowing them to actually do the necessary maintenance?

Post a Comment