by Graeme Gordon

"Naturally the Liberals won’t admit that this thing is meant to pump money into their coffers, so they’ve employed other methods of convincing the public that it’s a good thing."An excellent guide.

As usual B.C.'s carbon tax, being the first in North America, is cited by various "experts" (proponents of carbon taxes) to be a fine example of the effectiveness of such taxes in reducing carbon emissions. This has always struck me as a highly dubious claim for a number reasons:

1. StatsCan multi-year data show no significant differences in the pattern of fossil fuel consumption between BC and provinces without a carbon tax (the other nine).

2. Fuel prices are notoriously inelastic. Demand is relatively impervious to price changes. People use what they gotta use.

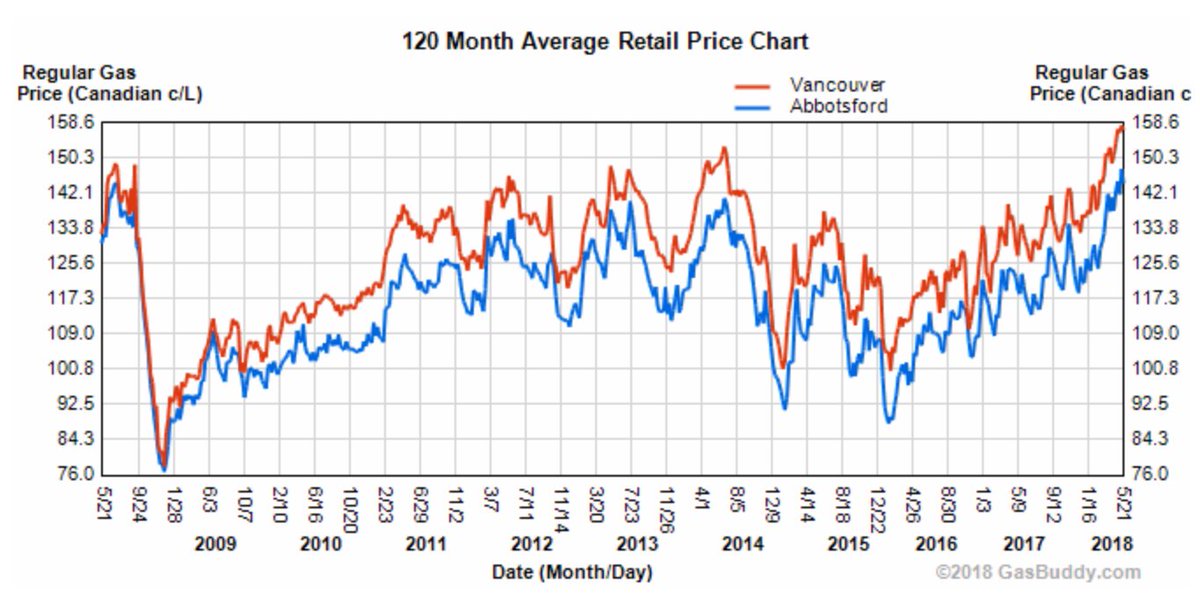

3. BC's carbon tax (2.4 c/L in 2008 - 7.78 c/L in 2018) is utterly swamped by market price fluctuations. So, even ignoring point 2, trying to attribute consumer demand changes to the carbon tax is extremely difficult. From GasBuddy: